43 a 10 year bond with a 9 annual coupon

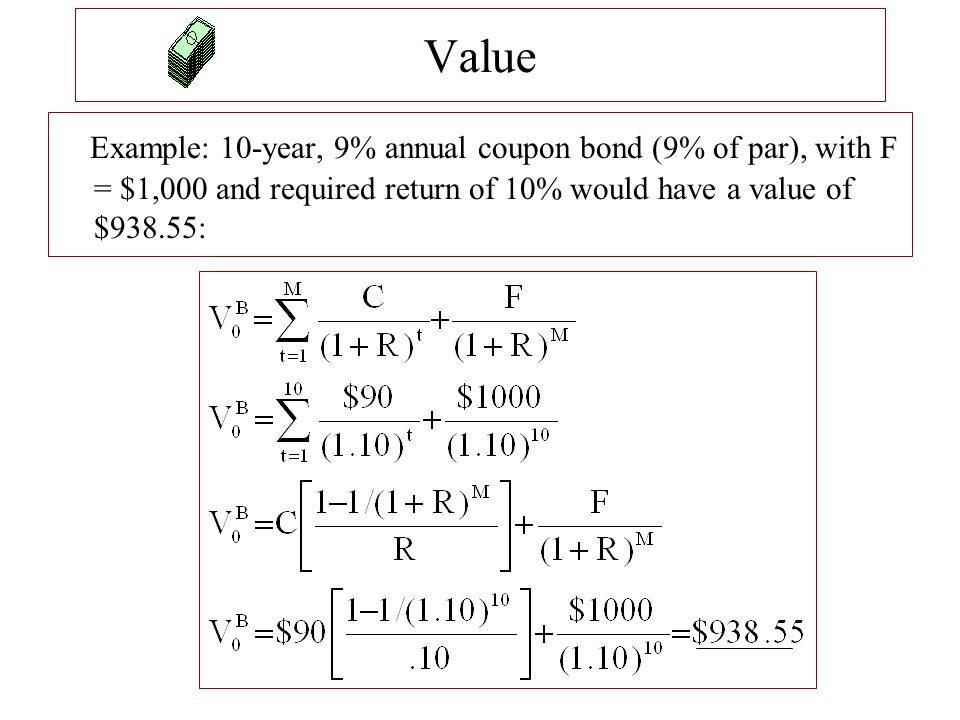

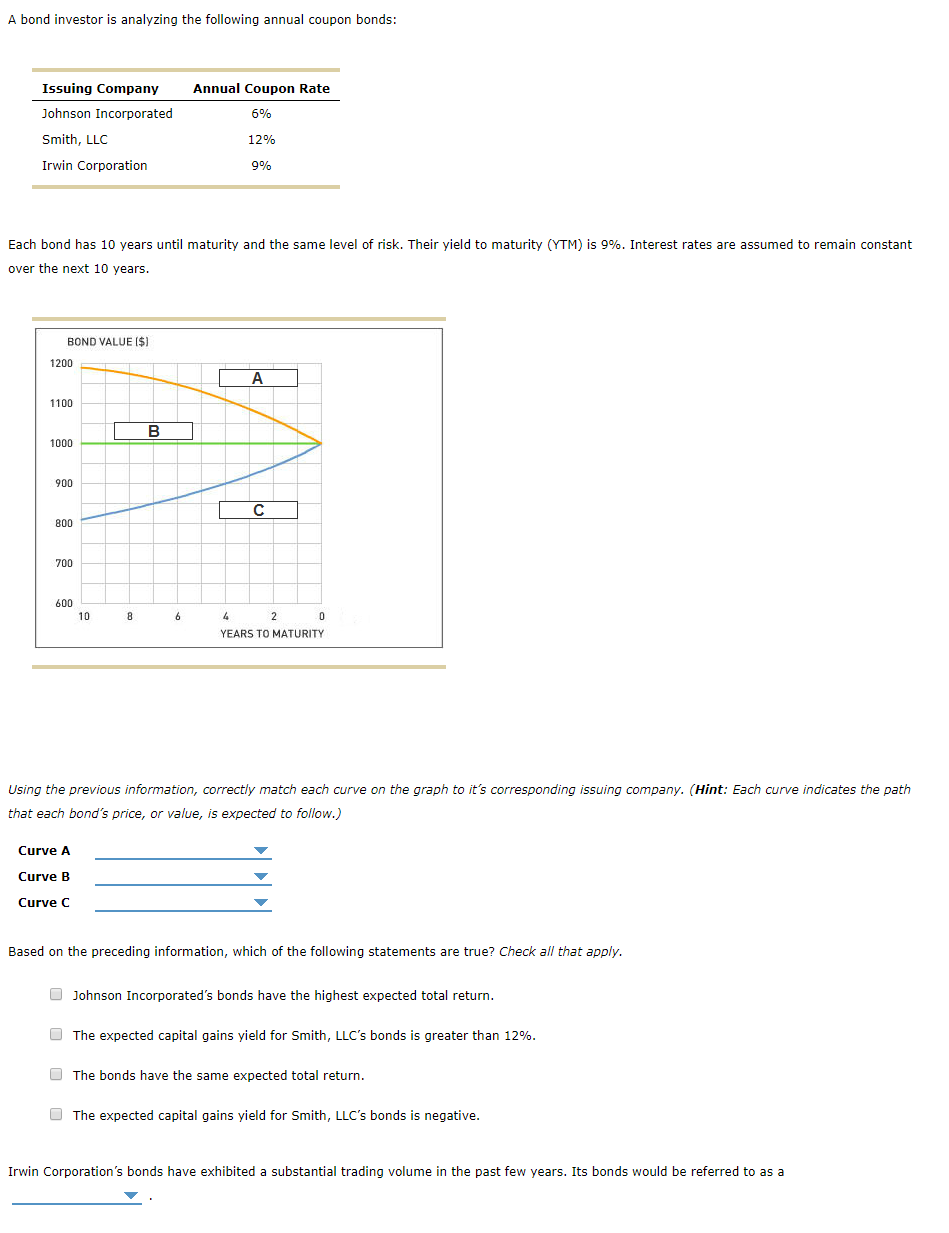

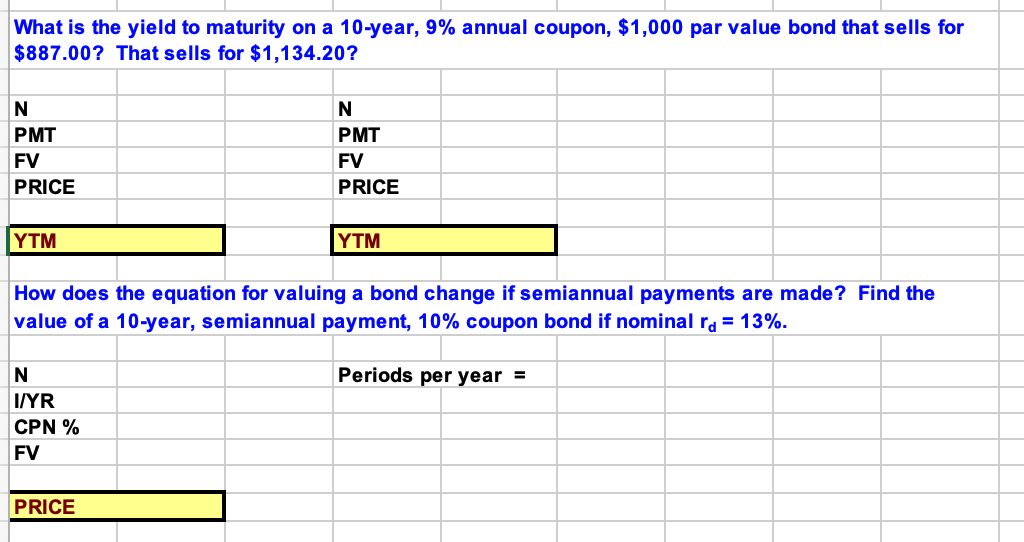

📈What is the price of a two year bond with a 9% annual coupon and a ... We can determine the bond price using the present value formula of a single cash flow for all cash flows. PV=FV/ (1+r)^N FV=future cash flow ( annual coupons for 2 years and face value) annual coupon=face value*coupon rate face value=100 coupon rate=9% annual coupon =100*9% annual coupo n=9 r=discount rate=8% A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

What is the value of a 10-year, $1,000 par value bond with a 10 ... - Quora When you buy a bond for, say $1000, and the coupon rate is 10% for 10 years, paying you $100 per year. Where is the profit in that? You get the $1000 back at maturity. So you collect $100 of interest for 10 years and receive $1000 of principal at maturity. So you collect a total of $2000 for your $1000 investment. 14 David Friedman

A 10 year bond with a 9 annual coupon

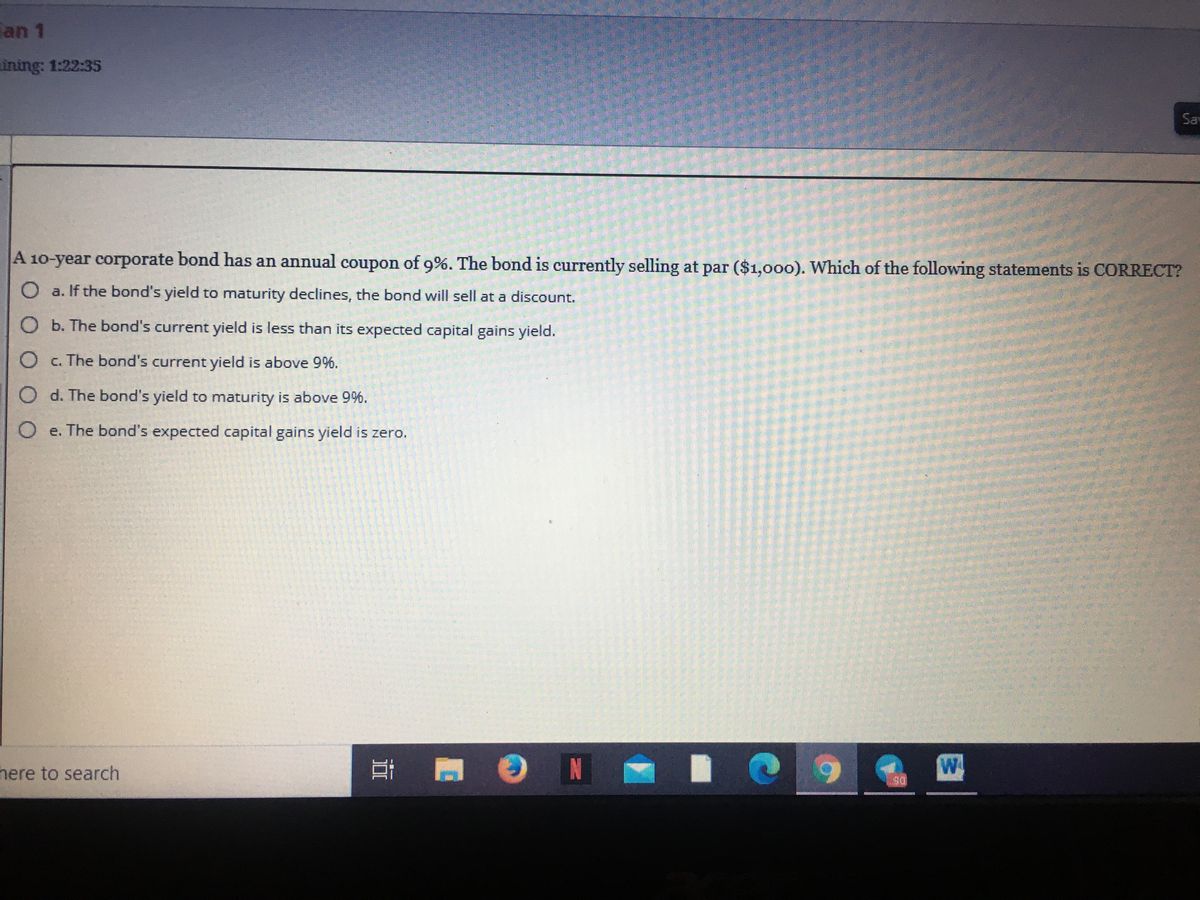

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5. Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

A 10 year bond with a 9 annual coupon. Suppose you purchase a 10 -year bond with \( 6.2 \% | Chegg.com Expert Answer. Suppose you purchase a 10 -year bond with 6.2% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.9% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. Six-year bond with annual coupons is bought to yield 6.9:1Dominique LeBlanc is the owner of a new ten-year %50,000 8% par-value bond with Bermuda option and annual coupons. Allowable call dates are at the end of years 6 through 10, and the call premium at the end of year n is $300(10-n). A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora The coupon is 6% of 20,000 or 1200 per year. The interest rate used in present value calculation is the required rate of return of 8%. Using sum of geometric series The present value of the bond is 20,000 discounted at 8% for 5 years Final Answer: Fair Value = Continue Reading 4 Eric Kolovson

A 10 year bond with a 9 percent semiannual coupon is A 10 year bond with a 9 percent semiannual coupon is currently selling at par A from FIN 101 at Austin College. Study Resources. Main Menu; by School; ... A 10 year bond with a 9 percent semiannual coupon is currently selling at par A. A 10 year bond with a 9 percent semiannual coupon is. School Austin College; Course Title FIN 101; Type. Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c. Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount. › archivesArchives - Los Angeles Times You can also browse by year and month on our historical sitemap. Searching for printed articles and pages (1881 to the present) Readers can search printed pages and article clips going back to ...

Coupon Bond: Definition, How They Work, Example, and Use Today Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... › terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... › 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of November 09, 2022 is 4.12%. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100 CY = 8.75%, The Current Yield is 8.75% The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond,

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg See the answer A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value Expert Answer

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

abcnews.go.com › USU.S. News | Latest National News, Videos & Photos - ABC News ... Nov 08, 2022 · Cops seized 28 lbs. of cocaine from the wheelchair -- an estimated 75,000 doses. The suspect is student Christopher Darnell Jones Jr. A motive isn't known. Anti-Semitic incidents have increased by ...

A 10 year annual coupon bond was issued four years A 10-year annual coupon bond was issued four years ago at par. Since then the bond's yield to maturity (YTM) has increased from 7% to 9%. Which of the following statements is true about the current market price of the bond? a. The bond is selling at a discount b. The bond is selling at par c. The bond is selling at a premium d. The bond is selling at book value e.

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Answered: Suppose a 10-year, $1,000 bond with a… | bartleby Transcribed Image Text: Suppose a 10-year, $1,000 bond with a 8% coupon rate and semiannual coupons is trading for a price of $1,037.12. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? ... Annual Revenue = $200,000 Operating Expenses = $80,000 Annual Depreciation = $20,000 ...

FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

What is the price of a two year bond with a 9% annual coupon and a ... 2 years Coupon rate = 9%. Yield to maturity = 8%. Formula to Calculate Bond Price. The formula for bond pricing. is basically the calculation of the present value of the probable future cash flows, which comprises of the coupon payments and the par value, which is the redemption amount on maturity.

[Solved] A bond that matures in 10 years has a 1000 par value The ... Step1 - Calculation for Annual payment of interest A n n u a l I n t e r e s t = F a c e v a l u e × R a t e o f i n t e r e s t = $ 1, 000 × 9 % = $ 90 Step2 - Calculation for value of annual paying bond Value of bonds can be calculated by using 'PV' formula of spreadsheet or Excel The formula is shown below

Solved Suppose a 10 -year, \( \$ 1,000 \) bond with a(n) \( | Chegg.com We have to calculate YTM of semi annual bond: We are using BA II PLUS We have to keep PMT and FV : n …. View the full answer. Suppose a 10 -year, $1,000 bond with a (n) 12% coupon rate and semiannual coupons is trading for a price of $1,058.44. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)?

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

› investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 1 day ago · Coupon Rate 4.125%; Maturity Nov 15, 2032; Performance. 5 Day ... The 7.7% annual headline inflation rate in October is ‘very limited relief’ for consumers ... Japan 10 Year Government Bond-0. ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

› us › productsiShares 10+ Year Investment Grade Corporate Bond ETF | IGLB Nov 10, 2022 · The iShares 10+ Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated investment-grade corporate bonds with remaining maturities greater than ten years.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If...

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5.

Post a Comment for "43 a 10 year bond with a 9 annual coupon"