45 risk of zero coupon bonds

Ordinary citizens face higher risk in buying corporate bonds Zero Coupon Bonds and How They Work; Bonds - Investing in Bonds for a Secured Future; The 3 R's of Bond Investments - Risk, ... Ordinary citizens face higher risk in buying corporate bonds have 452 words, post on at September 10, 2022. This is cached page on VietNam Breaking News. If you want remove this page, ... The ABCs of Zero Coupon Bonds - Financial Directions One of the biggest risks of zero coupon bonds is their sensitivity to swings in interest rates. In a rising interest rate environment, their value is likely ...

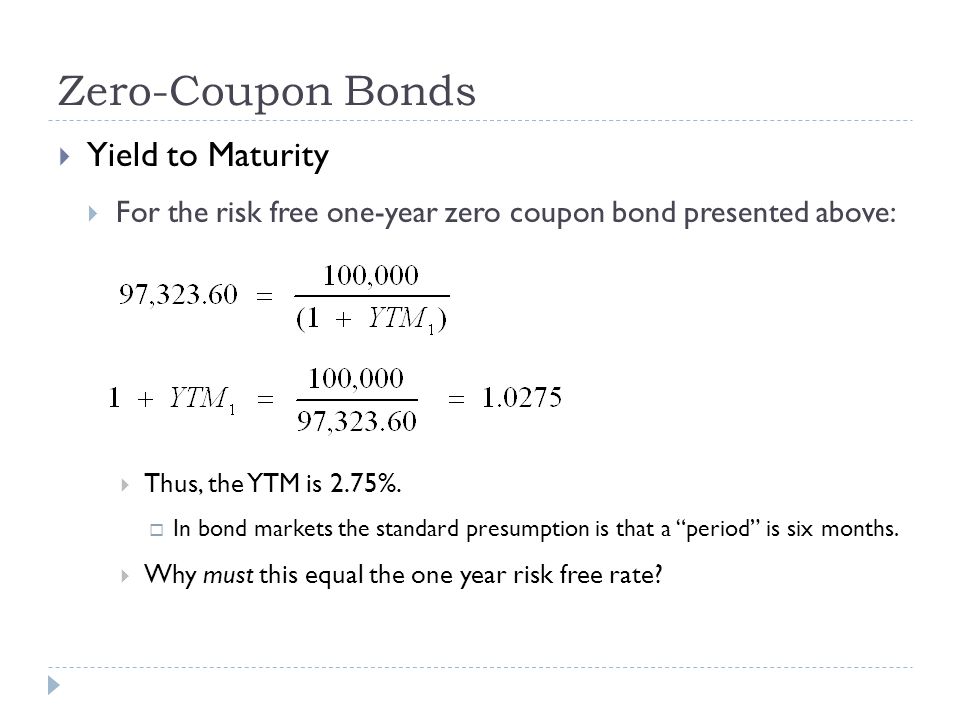

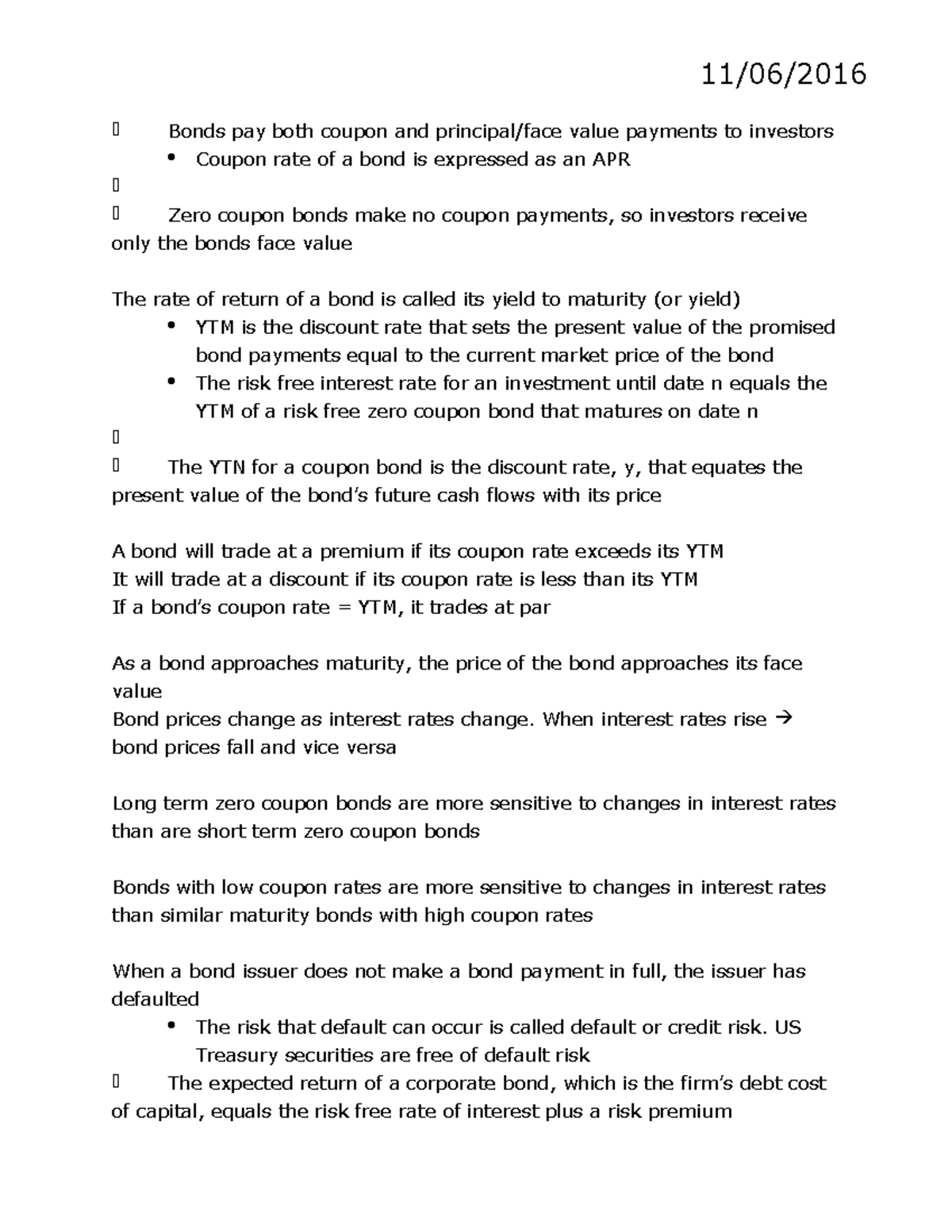

Vanguard - Fixed income - Corporate bonds Zero coupon bonds pay no periodic interest. The bonds are purchased at a discount and redeemed for the full face value at maturity. Generally, investors must pay income tax on interest accrued annually on zero coupon bonds even though no cash interest payments are received. Investors should consult a tax professional for additional information.

Risk of zero coupon bonds

Invest in G-SEC STRIPS India - Bondsindia.com Stripping is the process of separating a standard coupon-bearing bond into its individual coupon and principal components. For example, a 10 year coupon bearing bond can be stripped into 20 coupon and one principal instruments, all of which thenceforth would become zero coupon bonds. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

Risk of zero coupon bonds. What Are Zero Coupon Bonds And Their Risks - Tavaga Risks associated with Zero-Coupon Bonds ... As there is no coupon rate, ZCBs are safer as compared to other fixed-income instruments, which are sensitive to ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Also, zeros may not keep pace with inflation. And while there is little risk of default with Treasury zeros, default risk is something to be mindful of when researching and investing in corporate and municipal zero-coupon bonds. Interest Is NOT Invisible to the IRS. One last thing you should know about zero-coupon bonds is the way they are taxed. Zero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · “Zero coupon bonds are highly beneficial when the interest rates are high and there is no re-investment risk during the life period of the bond for the investors,” said Srinivasan of Rockfort ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. Hence, investors do not ...

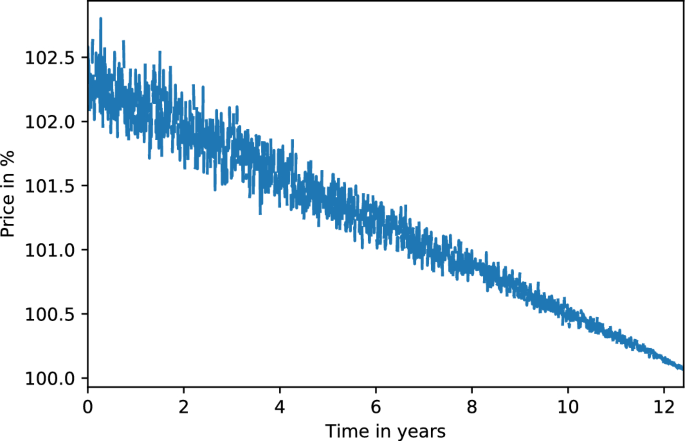

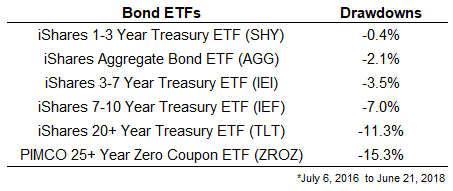

What Is a Zero-Coupon Bond? Definition, Advantages, Risks 28 Jul 2022 — Drawbacks of zero-coupon bonds · They're very sensitive to interest rates · You have to pay taxes on income you don't get · There is a default risk. The Basics Of Bonds - Investopedia 31.7.2022 · Bonds represent the debts of issuers, such as companies or governments. These debts are sliced up and sold to investors in smaller units. For example, a $1 million debt issue may be allocated to ... Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Zero-Coupon Bond - Definition, How It Works, Formula 28.1.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and … Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Invest in G-SEC STRIPS India - Bondsindia.com Stripping is the process of separating a standard coupon-bearing bond into its individual coupon and principal components. For example, a 10 year coupon bearing bond can be stripped into 20 coupon and one principal instruments, all of which thenceforth would become zero coupon bonds.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 risk of zero coupon bonds"